While the state can help with some costs, eligibility for help is limited and many people find themselves over the threshold for support so it is important to be aware of financial options available to you.

Long-term care costs are high and industry trends suggest fees will continue to rise, so what are the costs and options?

Care at home

Most of us would like to stay in our own homes – and local authorities try to enable this for as long as possible. The average cost of home care is £15 an hour, so just two hours of daily home care could amount to almost £10,950 a year. Live-in care can start at around £27,612 a year.

Residential care

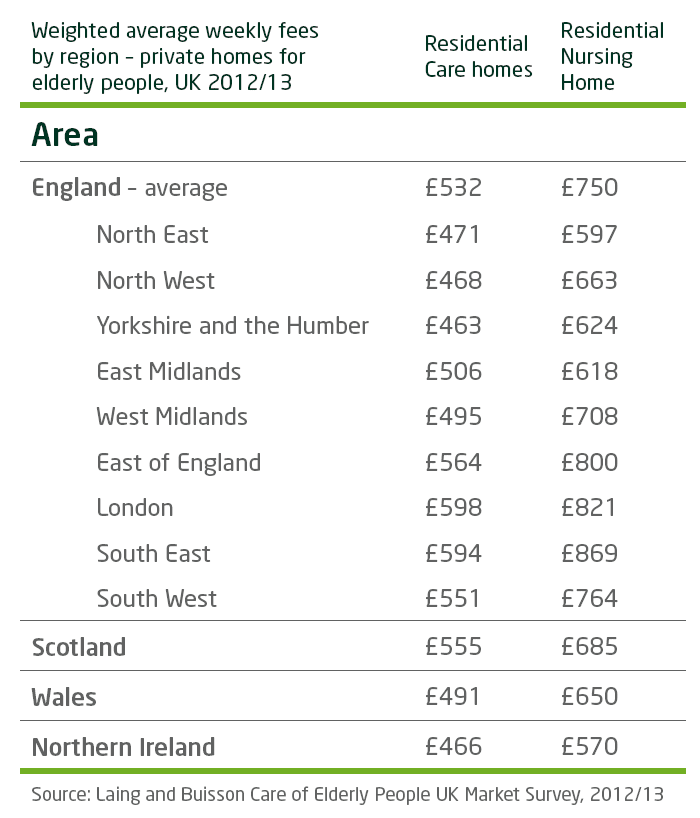

The cost of residential care can vary hugely by location and depending on whether an individual requires nursing or not. The table below details the regional variations in the cost of care:

Average weekly care home fees around the UK 2012/13

On average an individual can expect to pay around £27,144 a year for a residential care home, rising to over £38,000 if nursing is required. This is based on 2012/2013 data and costs are higher in London and the South East.

Other costs

Remember too that these are only the costs of residency and nursing. Costs that may still need to be met on top of a care home’s bill might include:

- Clothing, toiletries and personal items

- Trips and treats

- Telephone calls

If care is fully funded by the local authority, you are allowed to retain a Personal Expense Allowance to cover items like these. When looking for a home it is important to ascertain what is included in the fees and what isn’t.

People are living longer

The costs can be end up being greater than originally anticipated. While the average life expectancy for an individual going into long term care is around 2 and a half years*, this allows for severely sick and disabled people requiring nursing care admitted straight from hospital and therefore receiving state funding.

If we remove this group of care residents from the statistics, our experience suggests that the average stay in a care home for a self-funder is actually more like 4 years, with a 1 in 8 chance of living over 7 years.

*PSSRU, Length of Stay in Care Homes, Jan 2011

What are the State Provisions and Limits?

While the State can help with some costs, eligibility for help is limited and many people find themselves over the threshold at which state support is provided, currently £23,250 in England (national variations do apply).

The subject of state funding of long term care has been receiving increased attention following the government’s recent announcement that from 2016 a new £72,000 cap will be introduced to limit the amount people have to contribute to their own care costs. This is an important step forward in the reform of adult social care, however, concerns have been raised that there is insufficient clarity about exactly what the cap will cover.

A key point is that the cap will only apply to ‘personal social care’, typically a third of all residential care costs. The cap will not cover general living expenses (estimated to be between £8,000–£10,000 per year), or any costs for care which are above the rate that would be paid by the local authority. This may not be the actual cost of the care needed, as, in many cases, care in private residential homes costs more than local authorities would pay. This means that both before and after an individual reaches the £72,000 threshold, there may still be a gap which has to be made up from their own funds.

The Future and Financial Advice

This cap is welcomed as a positive step forward, but we caution that those who must pay for their own care in full will still be liable for significant costs both for their accommodation and in the run up to reaching this cap. It is therefore welcome that as part of the Government’s plans for information and advice, a referral to obtain regulated financial advice is included which will allow people to find out more about the available options to help pay for their care.

A Government produced guide is available on the following link:

https://www.moneyadviceservice.org.uk/en/categories/long-term-care

This guide will cover all the current key issues for anyone thinking about the funding of care. Please note that it is not within the scope of this guide to provide all of the information and guidance relevant to your specific circumstances.

To ensure that you are getting the best information to help you make the right decisions for your (or a relative’s) care we recommend that you speak to a Specialist Care Fees Adviser. This is where Sterling and Law can help as we have a number of independent specialists that hold the Care Fees qualification.

Written by Bradley Jones, Dip PFS, Independent Financial Consultant, Sterling & Law Group plc.

1 Laing and Buisson, Care of Elderly People, UK Market Survey, 2012/13