The secret of being an effective saver

The secret of being an effective saver You might think I’ll say that the best way to be an effective saver is by not spending. Not necessarily. We all have to live and life can be expensive. But saving on a regular basis is the best way to build up a solid chunk of money. […]

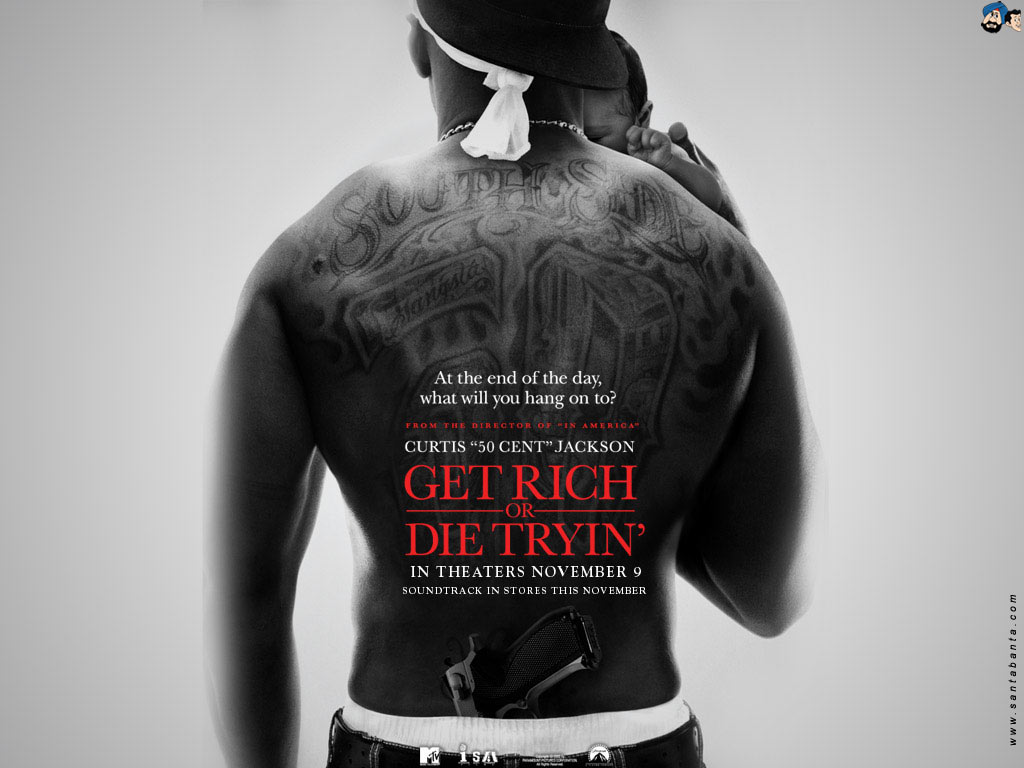

Get rich or die trying? Why?

Hard not to argue with the clarity of 50 Cent’s overall life goals, but dare I say it’s a little more complicated for the rest of us. What does money mean to you? I mean really? Yes, there is the standard glib answer that everyone wants more so they can buy more stuff and do […]

5 ways to give your employer’s pension scheme a boost

5 ways to give your employer’s pension scheme a boost A lot of thinking went into a setting up a personal pension in the old days, especially when there wasn’t an employer’s pension scheme you could join. You’d have to decide on your risk appetite, which pension provider to go with, your investment strategy, which […]

Ethical investments: Five reasons to invest ethically

Ethical investments – why invest? For those who want to invest their money ethically, there are many more options than there used to be, and a lot of these options are producing healthy returns. In many cases, ethical funds have outperformed their mainstream counterparts, which shows that profit and principles can go hand in hand. […]

5 reasons to be afraid of Pension Freedom

This month, the new Pension Freedom rules came into force. Now, if you are over the age of 55 you have the freedom to take control of your pension and retirement income. In other words, you can withdraw your entire pension fund and blow it on a cruise of you wish. Generally, this is great […]

5 steps to turn your income into real wealth

Don’t be fooled. You may be a high earner, but you cannot call yourself wealthy until you have accumulated CAPITAL. Income and wealth have incorrectly become synonymous in Western culture. Whilst the two concepts often go hand in hand, using the terms interchangeably is misleading. The UK’s most wealthy individuals don’t necessarily draw the largest […]

Investing – you get what you pay for

If you are considering investing your primary concern will probably be the performance of your investments. However, performance isn’t all you should be concerned about. The charges you pay can have a significant impact on your returns. Unnecessarily high costs coupled with poor returns can eat away at your investment. So how can we help […]

Will Auto Enrolment solve the UK’s pension problems?

The plan: The Government has introduced a compulsory pension scheme, which means that millions of UK employees will gradually see a slice of their salaries being automatically diverted into a pension pot for their retirement. Employers are obliged to contribute too with the government also adding to the pot through tax relief. The system, known […]